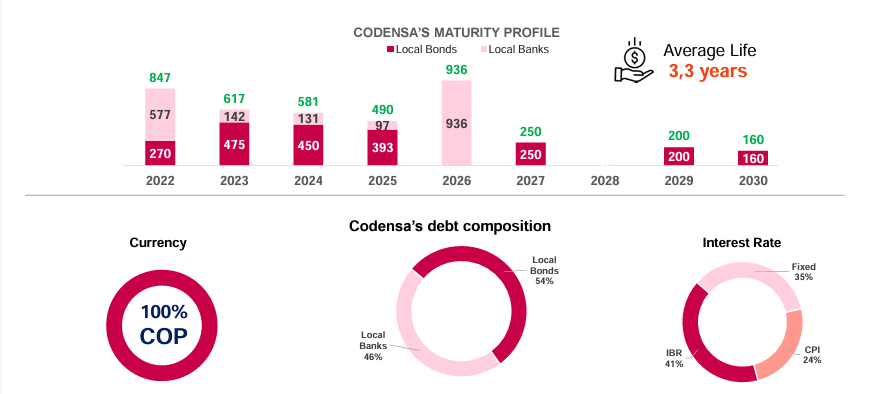

At the close of September 2021, net financial debt, including interest payable, amounted to $3.2 trillion pesos, representing a growth of 32.0% compared to the annual balance of 2020.

Throughout the year, the company secured loans as follows:

- Between January and February, it entered into development loans with Findeter through Itaú as an intermediary bank for $45.536 billion pesos, with maturities of two and three years. These loans were obtained through the rediscount line with compensated interest rates enabled by the national government for public electricity service providers that implemented deferral measures for billing costs to residential users.

- $450.000 billion pesos corresponding to a loan with Bancolombia on April 5, 2021, maturing on April 5, 2022.

- $400.000 billion pesos corresponding to a loan with Scotiabank Colpatria on May 14, 2021, maturing on May 14, 2026.

- $300.000 billion pesos corresponding to a loan with Bancolombia on July 15, 2021, maturing on July 15, 2026.

The proceeds from these operations have been used to refinance financial obligations and meet the company's capex needs.

During the period, the loan with Bank of Tokyo for $397.500 billion pesos was repaid in April 2021, and the maturity of the third tranche of the Company's Program and Issuance Placement occurred on September 27, 2021, for $185.000 billion pesos.

As of the end of September 2021, the entire financial debt of Codensa was denominated in pesos, with an average life of 2.34 years.