Emgesa’s total liabilities at the end of 2021 amounted to $ 3,934,516 million, showing a YoY decrease of 9.3%, mainly explained by the amortization of the International Bond in January and the amortization of the Third Tranche of Ordinary Bonds in July, which were partially offset by the acquisition of three bank loans, totaling $450 billion with local entities; and by the acquisition of three bank loans, totaling $450 billion with local entities; and by the reduction of accounts payable to related entities by 83%, derived from the payment in December of retained earnings to Enel Américas and Grupo Energía Bogotá, decreed in July of the same year.

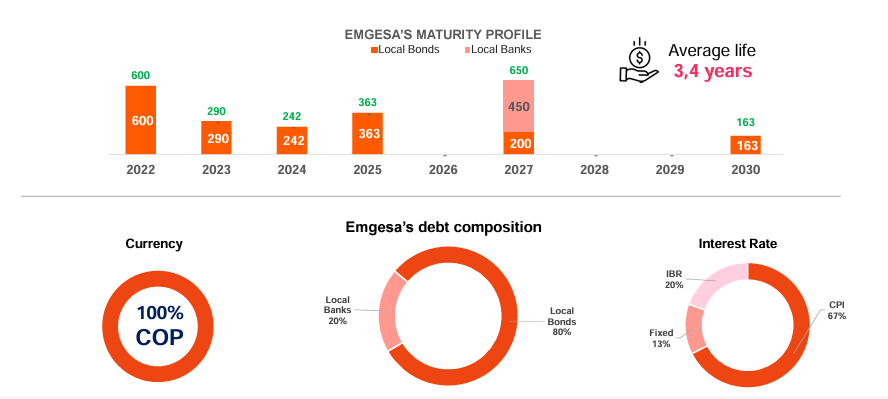

As of December 2021, Emgesa’s net financial debt amounted to $ 2,149,816 million, presenting an increase of 16.96% with respect to the balance at December 31, 2020, mainly due to the effect of a decrease in the available, which was used to meet the needs of Capex and General Corporate purposes. In addition, during 2021, Emgesa contracted loans for $450 billion to refinance obligations, which are detailed below: 1. $100 billion with BBVA on October 19, 2021, maturing on October 19, 2027. 2. $150 billion with Bancolombia on November 30, 2021, maturing on November 30, 2027. 3. $200 billion with Bancolombia on December 23, 2021, maturing on December 23, 2027. As of 2021, Emgesa maintained 100% of its debt in pesos, where 74% corresponds to long-term financial debt (remaining maturity of more than one year). The composition by interest rate is distributed as follows: 67% is indexed to the CPI, 20% indexed to the IBR, and the remaining 13% is at a fixed rate.