Information at the close of 2025:

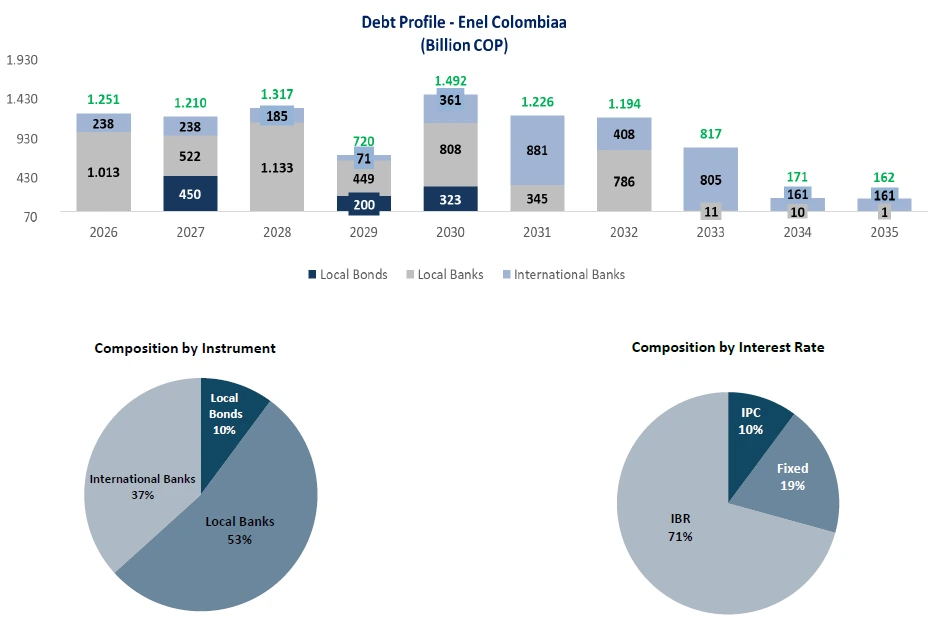

At the end of December 2025, Enel Colombia's net financial debt (excluding Central America) reached COP 9.56 trillion.

During the year, the company took out the following loans:

- COP 70 billion from Banco de Bogotá on February 19, with a 10-year term, through Findeter's Energy Efficiency rediscount line for the Generation business. The funds received were used for general corporate purposes.

- COP$159 billion from Banco Itaú on June 19, with a 4-year term. The funds received were used to prepay for an existing financial obligation.

- COP$130 billion from Banco BBVA under the sustainable credit line on September 11, with a 5-year term. The funds from this loan will be used to partially finance the construction of the Guayepo III and Atlántico Solar Parks.

- COP $1.2 trillion with Bancolombia, Banco Popular, and Banco Davivienda on November 26, 2025, distributed as follows: Bancolombia for COP $775 billion through a sustainable line, with a 7-year term, Banco Popular for COP $300 billion with a 4-year term, and Banco Davivienda for COP $125 billion with a 6-year term. The funds received were used to partially finance the construction of the Guayepo III and Atlántico Solar Parks and for general corporate purposes.

- COP 660 billion with Banco Davivienda on December 22, 2025, with a term of 5 years. The funds received were used to prepay two outstanding financial obligations in full.

Additionally, on July 22, 2025, the company received a disbursement of USD 100 million (equivalent in Colombian pesos), under the credit agreement signed with the European Investment Bank (EIB) on June 20, 2025, for a total amount of up to USD 200 million (equivalent in Colombian pesos). This transaction is partially guaranteed by SACE, the Italian Export Credit Agency. The disbursed amount has a term of ten years, with semi-annual interest payments and an amortization schedule that includes payments equivalent to 2.5% of the disbursed amount between years one and eight, and the remaining 40% during years nine and ten. The funds will be used to finance the construction of the Guayepo III and Atlántico solar parks.

During the period, the Second Tranche of Ordinary Bonds and Commercial Paper of Codensa, now Enel Colombia, matured for a value of three hundred and seventy-five billion Colombian pesos (375,000,000,000), and Series E of the Sixth Tranche of Ordinary Bonds under the same program was canceled, for a value of two hundred billion Colombian pesos (200,000,000,000). In addition, the Fifth Tranche of Ordinary Bonds under the Program for the Issuance and Placement of Ordinary Bonds, Ordinary Green Bonds, Ordinary Social Bonds, Ordinary Sustainable Bonds, Ordinary Sustainability-Linked Bonds, and Commercial Paper of Enel Colombia S.A. ESP, worth five hundred and sixty-five billion Colombian pesos (565,000,000,000).

At the end of December 2025, Enel Colombia's entire financial debt was denominated in pesos and had an average maturity of 4.24 years.